32+ Business loan borrowing capacity

The new term loan includes a delayed draw facility meaning Marathon can draw 50 million at the time of closing and another 50 million 270 days after closing the press. But if you have a good handle then the money that you borrow will work perfectly according to your personal needs.

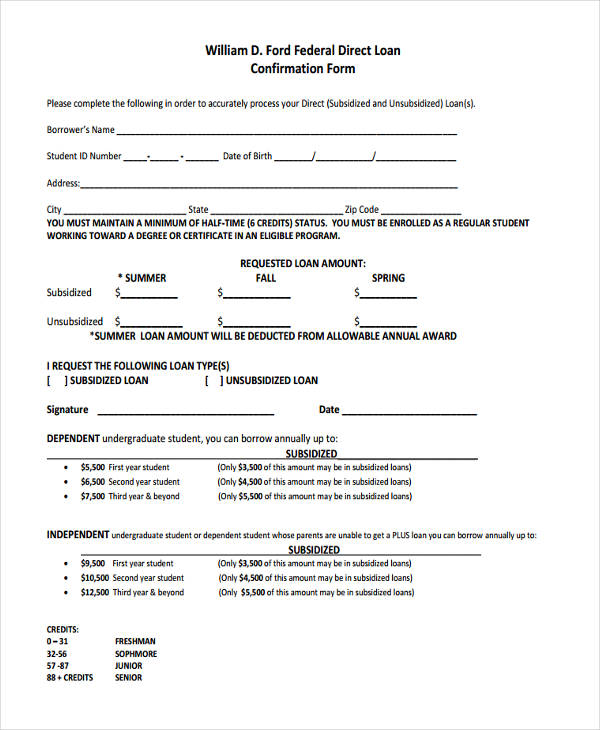

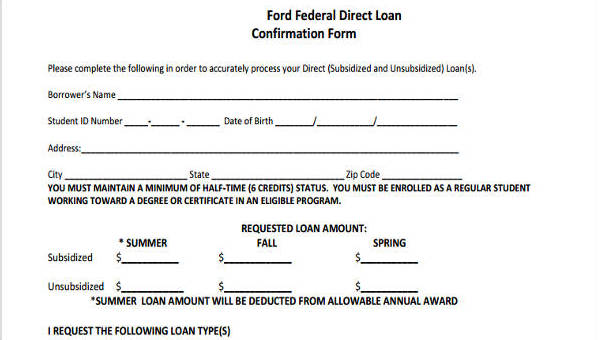

Free 8 Loan Confirmation Forms In Pdf

Borrowing capacity Self-financing capacity 3 or.

. The term is usually dictated by the loan purpose. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today. Loan to value ratio LVR is a measurement of the total.

Cash flow indicates how much money you. Buying or launching a new business. Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property.

A typical term loan at the bank for a business loan could be four five 10 years or longer. Interested in knowing how our funding solutions solve your business cash flow needs. Youll hear the term borrowing capacity on home loans your car loan.

Think about your cash flow. Some common reasons to consider a loan for your business include. Borrowing Capacity Calculator Please enter the information requested in the form to calculate the monthly repayments on your Loan.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Why to borrow. Usually this can be calculated as follows.

A borrowing base serves as a benchmark and protects them with. Instead of saying you need 50000 for new inventory for example you might figure out you need 20000 for new materials 10000 for shipping 15000 for labor and. View your borrowing capacity and estimated home loan repayments.

Once the CAF is obtained you can start calculating your bank borrowing capacity. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. When you put in those numbers in our Business Loan Calculator you will receive an estimated weekly or monthly repayment amount.

The borrowing capacity for home loans is generally much more conservative than for business loans. Expanding an existing business. We take pride in spending the time to deeply understand our clients.

About 380000 less After going through the above three tables we hope that you have a better understanding about how. For this specific example it would be an. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1 A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from.

Lenders prefer to use a business loan borrowing base because it provides them with a sense of security. Product Type Loan Term Years Interest Rate pa Your. A traditional term loan is often used to purchase.

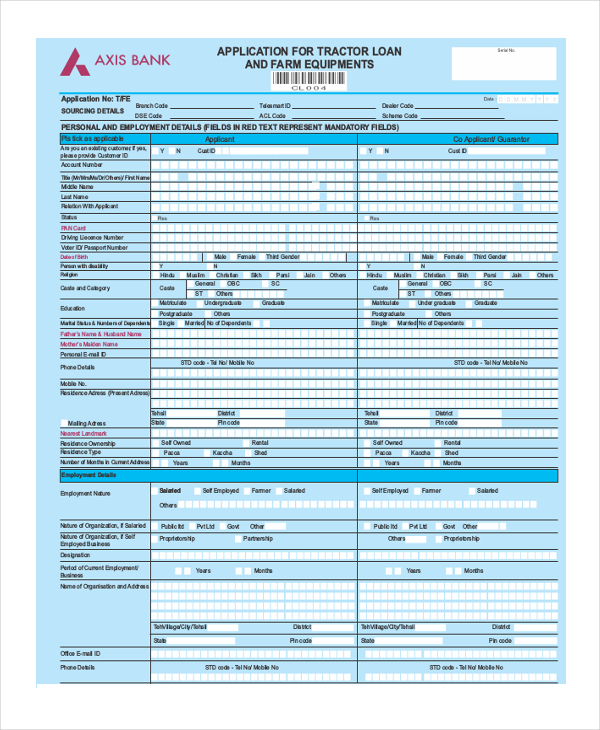

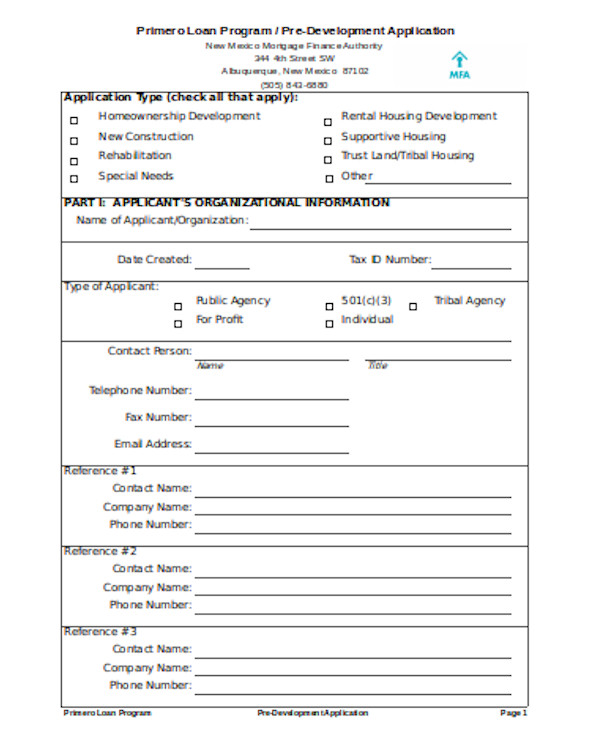

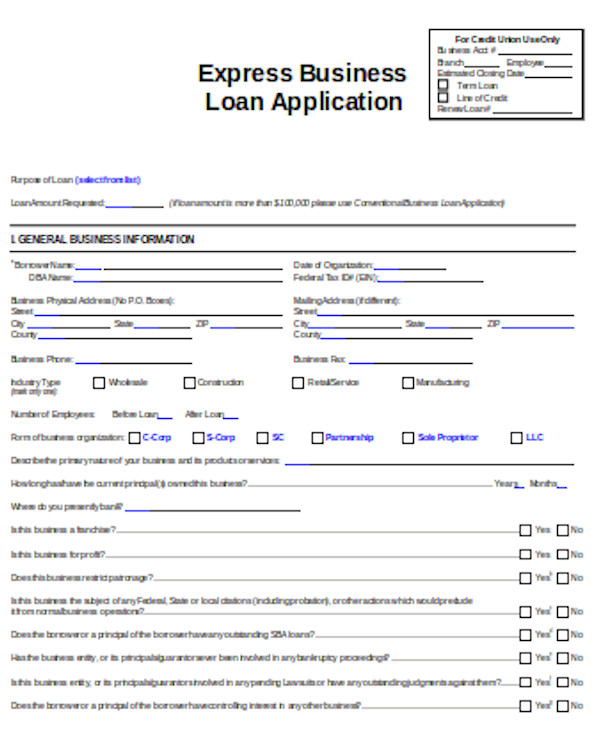

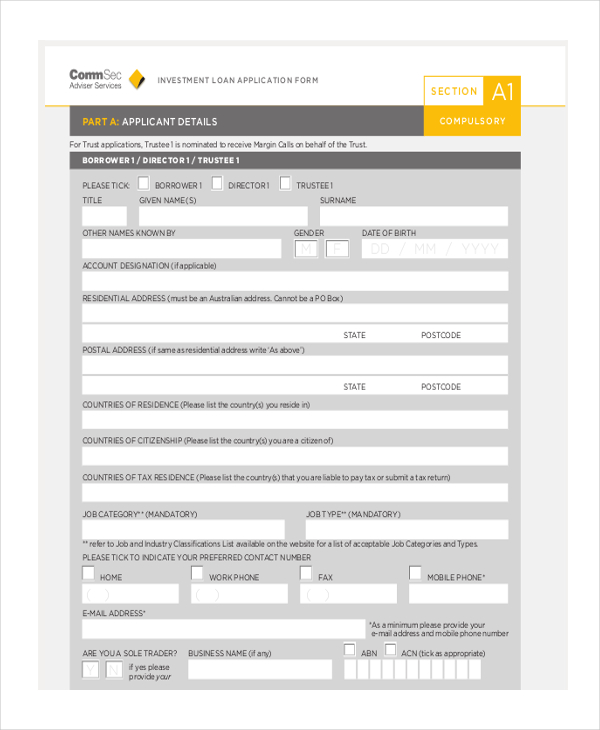

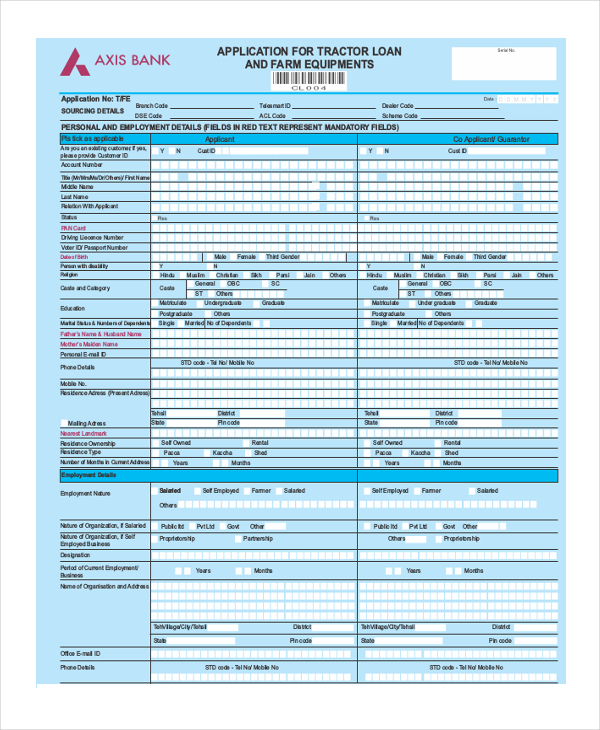

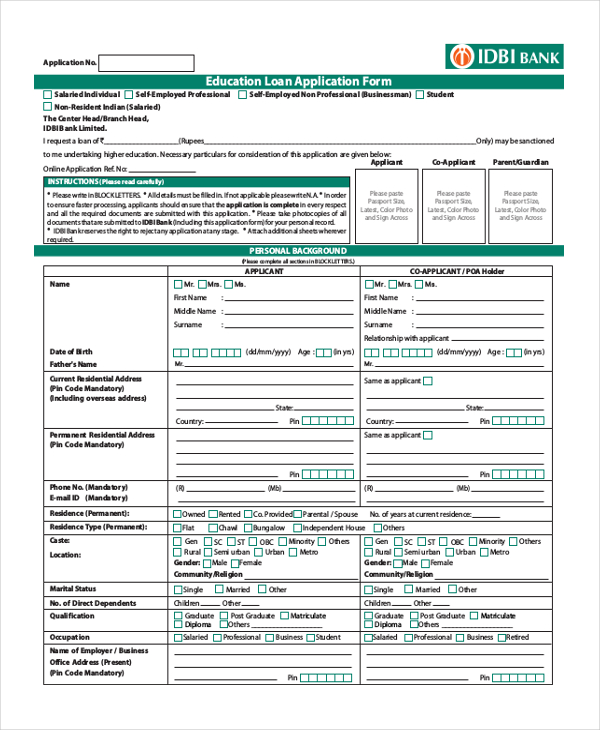

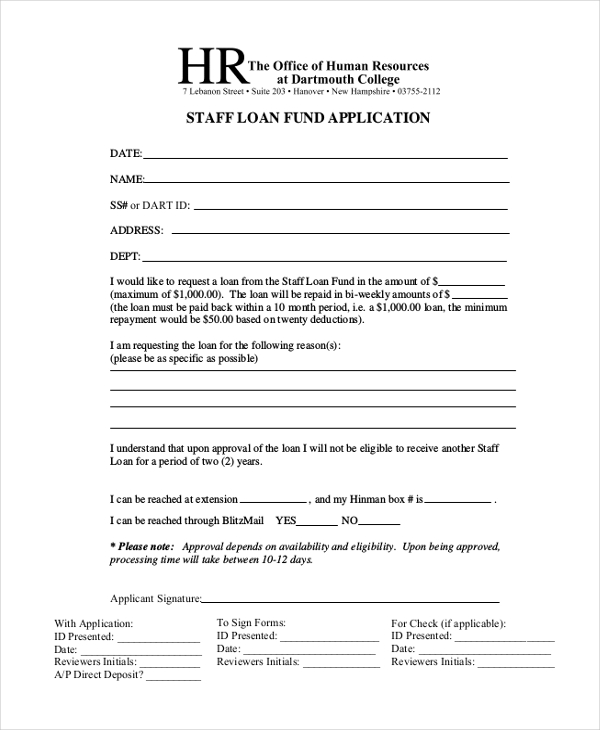

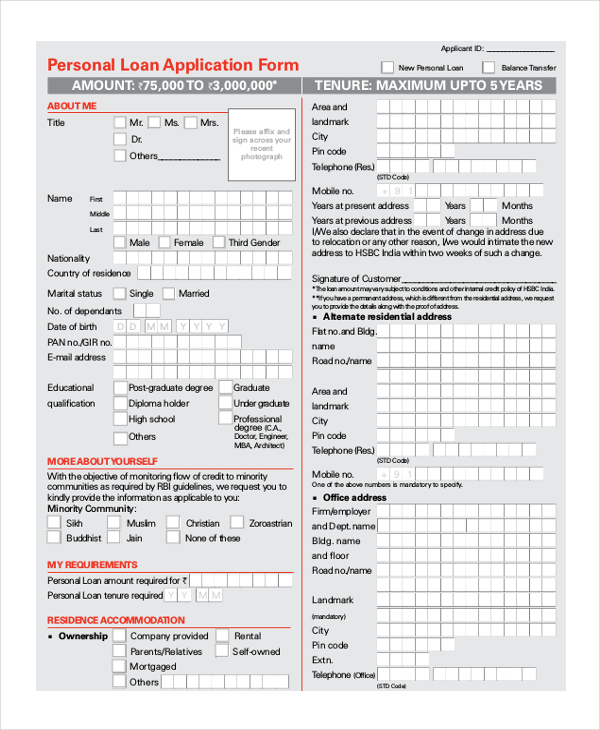

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

1

1

3

Simple Loan Application Form Template Fresh Equipment Borrowing Agreement Template Equipment Loan Application Form Loan Application Contract Template

Free Printable Loan Agreement Form Form Generic

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Interest Expense To Debt Ratio Formula Calculator Updated 2022

3

Free 8 Loan Confirmation Forms In Pdf

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Approved Small Business Loan Application Form And Money Approved Small Business Spon Business Loan Appr Small Business Loans Business Loans Sba Loans